+1 866-547-9277 US/CA

GBP

EUR

- TAG IT

- SCAN IT

- TRACK IT

+1 866-547-9277 US/CA

Fast, accurate, reliable scanning for easy reads.

Compare our two most popular scanner types to see which one works for you.

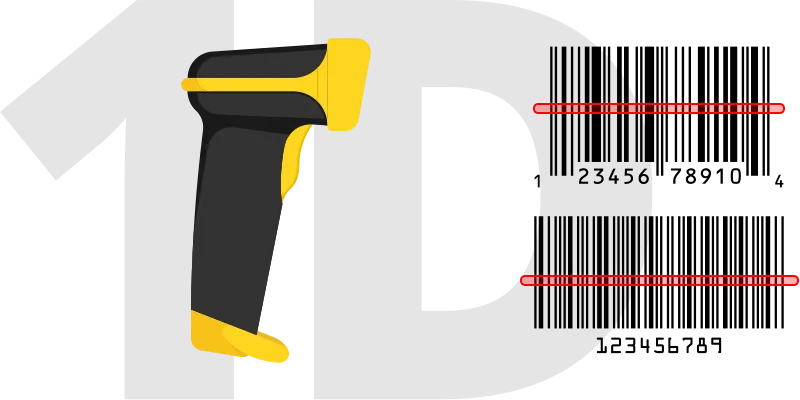

Laser scanners use a sharp beam of light to read 1D barcodes such as UPC, Code 128, and Code 39. They’re simple, reliable, and widely used across everyday tasks.

Key Benefits

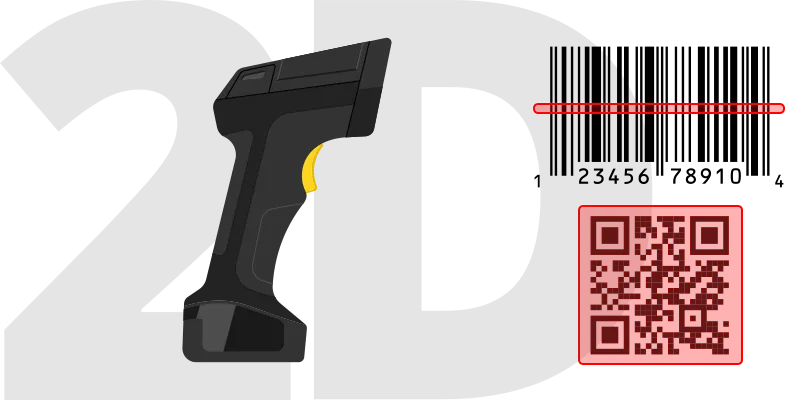

Imager scanners take a picture of the barcode and decode it quickly. They read 1D and 2D barcodes such as QR and Data Matrix, whether printed or on a screen.

Key Benefits

See how each technology supports different scanning needs.

SECURE

Best for fast, everyday 1D scanning. Great when you need quick reads at the counter or on the floor.

VERSATILE

Reads 1D and 2D barcodes on labels or screens. Ideal when you scan a mix of items or digital codes.

COST EFFECTIVE

Works well for close-range 1D scanning. Reliable for steady reads in checkout or point-of-sale setups.

Our sales team can help you find the best fit for your needs.

We see that you have items in your cart. Changing currency with an active shopping cart will result in those items being removed from your cart.

Purchases outside North America are transacted through our UK office directly. If you wish to continue browsing in USD, click the cancel button below or close this window, otherwise click Continue to switch currency.