My Cart,

- 25+ years devoted to providing turnkey tracking solutions to hundreds of thousands of clients worldwide.

-

Products

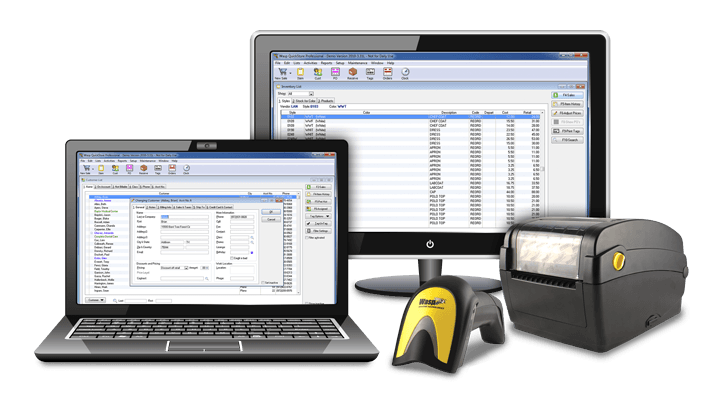

Software & Systems

Hardware & Supplies

-

Applications

Applications by Use Case

-

Support & Training

Frequent Support & Training Options

Other Resources

-

Company

Company

-

Partners

Partners

-

+1 866-547-9277

US/CA+1 866-547-9277

US/CA+44 845 430 1971

UK/EU+1 214-547-4100

Intl.